Insights

A collection of our recent articles, white papers, webinars, reports and videos.

ECB discloses new plans and milestones for TARGET Services

- No milestones to reach until March 2021

- New milestones have been added (User Testing activities started, Training for user testing started, Network connectivity tests on production started, Network connectivity tests on production completed)

- Milestones not completed in 2020 will be postponed between 8 and 12 months.

- NSP selection and contract preparation to be completed by 31 March 2021

- Software development for the required adaptation changes to TARGET2 to be completed by 30 June 2021

- Testing of the internal applications to be completed by 31 August 2021

- User Testing activities to be started by 1 December 2021

- All PSPs which have joined the SCTInst scheme and are reachable in TARGET2 should also become reachable in a TIPS central bank money liquidity account, either as a participant or as a reachable party (i.e. through the account of another PSP which is a participant)

- All ACHs offering instant payment services should migrate their technical accounts from TARGET2 to TIPS.

- 6 months to confirm, review or fine-tune their NSP choice for TARGET2

- 9 months to complete TARGET2 developments and 11 months to finalise testing

- Less than 15 months to set up their TIPS central bank money liquidity account

- NSP access in Cloud

- Intraday Liquidity

- Payments transformation

- Instant payments management in the new framework

The European Payments Ecosystem – Fintech Finance Virtual Arena

Mario Mendia, TAS Group’s International Markets SVP and Raphael Barisaac, Global Head of Cash Management and Global Co-head of Trade at Unicredit, were recently invited by Fintech Finance to speak with Ali Paterson in his Virtual Arena.

The topic was the dynamic European Payments scene today, how it’s evolving, the COVID-effect on payments, how ISO20022 is set to be a game-changer, and the challenges (and opportunities) of the T2/T2S Consolidation project.

Mario Mendia offered viewers valuable insights and shared his views on the upcoming changes to the Eurosystem, where TAS Group is playing an active role in the T2/T2S Consolidation Project.

In case you missed the Fintech Finace Virtual Arena discussion on the European Payments Ecosystem, you can watch it on our YouTube channel.

Beyond Target2 / T2S Consolidation

Need some expert help with ECMS or T2/T2S Consolidation? Get in touch

The new ECMS is coming – now is the time to act

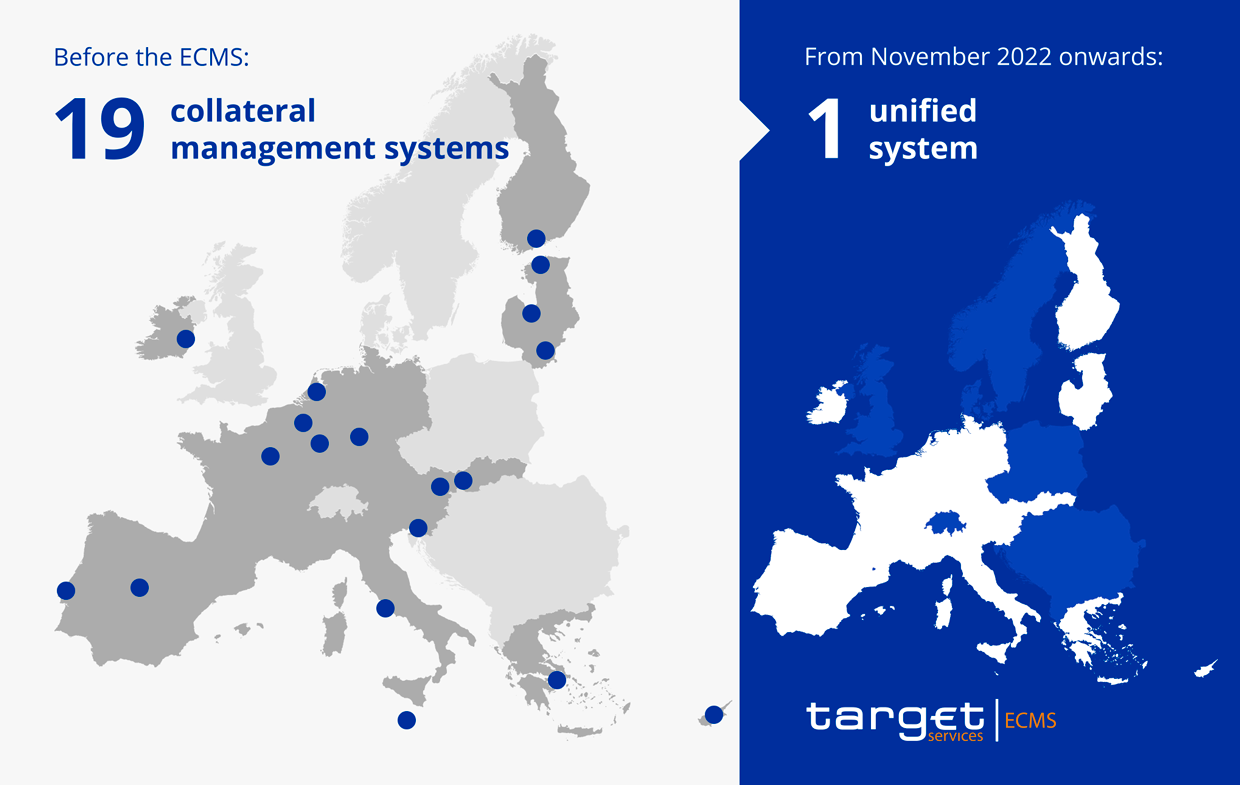

TAS Group has been closely following the developments of the new Eurosystem Collateral Management System (ECMS) as it has been doing for the T2 / T2S Consolidation milestone, and is actively helping banks to prepare, especially in managing collateral and treasury funding.

The ECMS, scheduled to go live in November 2022, will replace the existing individual systems of the 19 national central banks that are currently managing assets used as collateral for Eurosystem credit operations.

Our Aquarius Liquidity Management platform already manages the Central Bank’s Pooling Account and will guarantee in the future all the features currently being specified for the ECMS, in synergy with the liquidity management and securities settlement functions already covered by the solution.

Follow us to stay updated on the collaborative path led by TAS Group in partnership with Accenture and KPMGNeed some expert help with ECMS or T2/T2S Consolidation? Get in touch

Over 12 banks have selected TAS Group solutions to prepare for the T2/T2S Consolidation Project

Contact us

Get in touch to discover how we can help in achieving your business goals