Insights

A collection of our recent articles, white papers, webinars, reports and videos.

Infraxis showcasing its comprehensive Fuel technology at UNITI EXPO

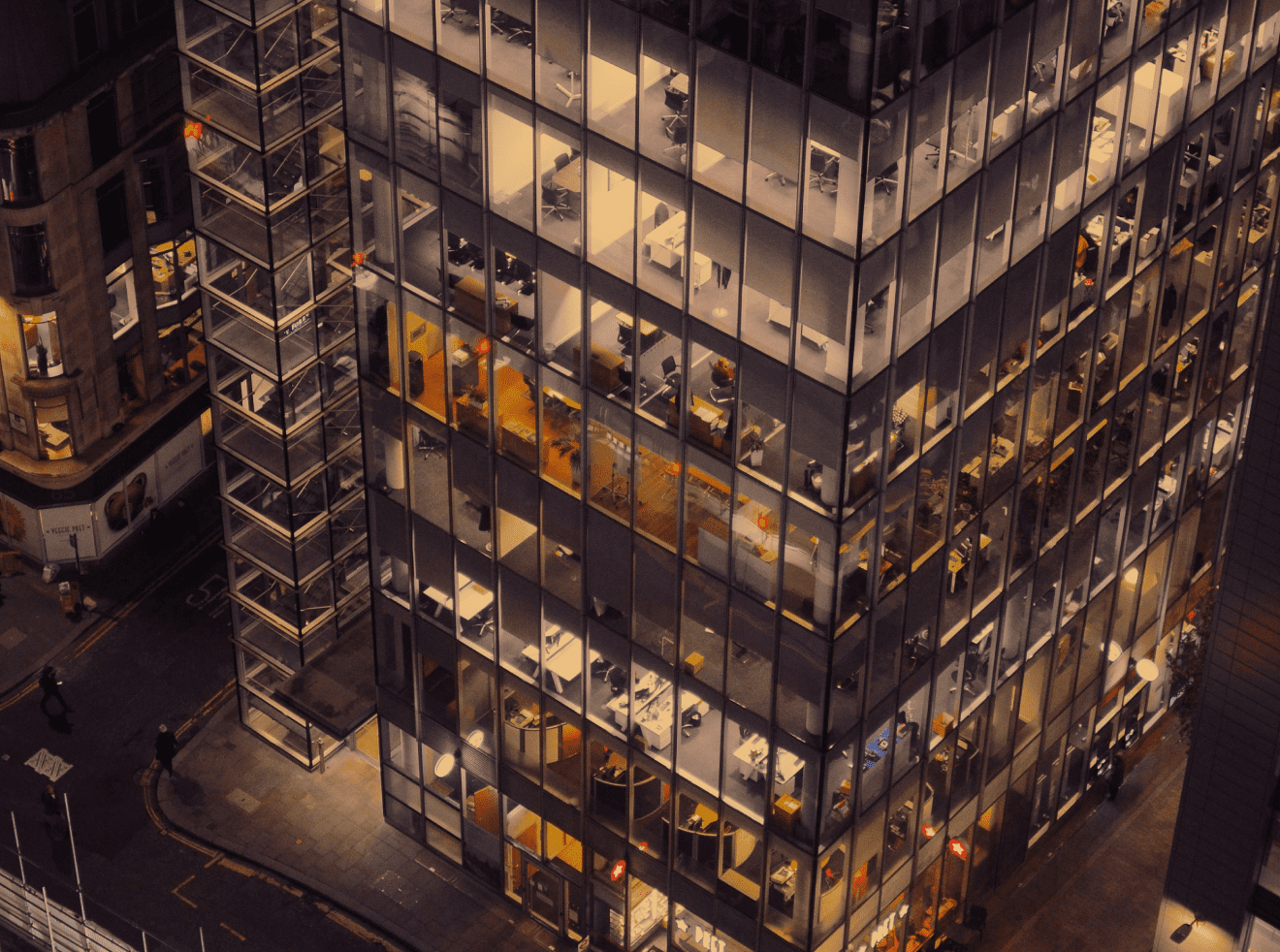

Lugano, 9 May 2022 – Infraxis AG, part of TAS Group, a leading technology provider in the Payments space, will be exhibiting at the upcoming UNITI EXPO taking place in Stuttgart from May 17 through 19. We’re proud to be at UNITI 2022, where we’ll be co-exhibiting with CCCBusiness Service AG, our processor partner servicing the top forecourt operators and fuel card issuers in Switzerland and beyond.

The state of the art PayStorm Fuel platform is powering CCC business by supporting leading Fuel Industry operators on a daily basis. Infraxis is continually investing in the PayStorm platform, bringing the challenger bank paradigm to the processing of fleet cards, forecourt acquiring and EV charging apps.

PayStorm efficiently solves challenges associated with acquiring and authorizing fuel card payments through its highly adaptable design, enabling the realization of different business needs within the minimum of time and with the minimum of cost.

“Whether your organization needs to acquire internationally branded cards, perform authorisation against a small to medium sized card portfolio, or to simply to switch out to a card issuer for authorisation, Infraxis has the solution ready to satisfy your processing requirements.”- commented Manfred Thomi, CEO of Infraxis.

At the UNITI Expo Infraxis stand visitors will be able to assess the ease of app integration via APIs for mobile-first onboarding and self-management for both fleet cards and international payment brands.

UNITI Expo, the leading retail petroleum and car wash trade fair in Europe, is finally back in-person, with 4 themed exhibiting areas. Infraxis AG welcomes all interested visitors in Hall 5, the Technology, Payment & Logistic area, at booth 5A20.

TAS migrates POS payment acceptance services to the cloud using Amazon Web Services and certifies itself as PCI-DSS Level 1 Service Provider

TAS Group invests in wearables fintech Flywallet

Milan (Italy), 22 June 2021– Flywallet S.r.l. (“Flywallet”), the innovative startup that created a digital platform for enabling payments and services through wearable devices with biometric authentication, has signed a reserved investment agreement for the entry of Global Payment S.p.A. (“GP”), a subsidiary of TAS Group’s mother company TAS S.p.A., into the capital with a minority stake.

TAS Group is a multinational company, whose payment software solutions are adopted by commercial and central banks throughout Europe and beyond. More than 100 million payment cards are managed by TAS platforms worldwide. Thanks to its leadership, TAS Group will be a vehicle to accelerate the go-to-market for Flywallet’s mobile wallet, the world’s first for tokenizing payment cards on wearables with biometric authentication. The partnership will also result in a commercial agreement under which GP will distribute Flywallet’s wearables and service platform to TAS Group's business customers.

Flywallet’s flagship product is named Keyble, a new type of wearable that adapts to the user’s lifestyle, created with eco-friendly materials and inspired by made-in-Italy styles. It consists of a smart device that can be inserted into fashion accessories such as bracelets or watch straps and is equipped with biometric sensors for user authentication and health monitoring.

Through fingerprints or heartbeat measured via ECG, the user can enable in-store contactless payments, passwordless logins to online services, ticketing, loyalty cards, access to gyms, offices and homes, car door locks, digital identity and more. In early 2022, the wearable will be certified as a medical device capable to perform analysis of cardiac arrhythmias, blood oxygen saturation and body temperature.

Flywallet is proposing a unique “Biometric Wearable Platform as a Service” model for e-money and payment institutions, banks, insurance companies and businesses. By connecting via dedicated APIs, the Flywallet Platform allows Partner companies to deliver new types of digital services easily and securely through the proprietary wearables.

Valentino Bravi, CEO of TAS stated: “At TAS, we have always applied the principles of “continuous innovation” to ensure the market a constant technological and functional evolution of our products and services, both through significant investments in R&D - more than 10% of our revenues in the last decade - and through the acquisition of innovative companies.

In 2019, for example, the acquisition of Mantica enabled us to expand our offerings in the Machine Learning and Artificial Intelligence areas.

Today, we are investing in Flywallet because we are convinced that offering wearable technology that is customizable and adaptable to our customers’ user experiences is a critical success factor.

We also appreciate that this project gives us the opportunity to reaffirm our decades-long commitment to promoting Italian technology in a sector that will undoubtedly improve our lives and make them more secure in the years to come.”

Lorenzo Frollini, Founder and CEO of Flywallet added: “It is an honour for Flywallet to count TAS among its shareholders and partners. Between TAS and Flywallet there is a perfect strategic fit and a total sharing of the company’s core values, including customer centricity and a relentless pursuit of service quality. In the medium term, the strategic partnership with TAS will also allow Flywallet to expand its range of services through the opportunities offered by PSD2.”

TAS Group brings its state-of-the-art card and mobile payments management platform to the Temenos MarketPlace

Temenos customers, from digital-first challengers to established banks, will now be able to design, issue and manage innovative payment products and enjoy unparalleled flexibility and time to market.

TAS Group has joined the Temenos MarketPlace making its card and digital payments solution, CARD 3.0 IE, available to Temenos customers around the world. With the addition of CARD 3.0 IE, Temenos clients can leverage a flexible, modular and scalable card issuing, acquiring and processing platform that can be deployed either on-premise or on the cloud. Card 3.0 IE enables banks to intelligently manage the entire card and digital payments value chain, including physical and virtual card issuance, card & PIN production, transaction processing, Apple and Google payments and payment analytics.

The Temenos Marketplace mission is to help banks find and connect with innovative fintech solutions from around the world in order to better meet customer needs. Through this ecosystem of incubators, banks and fintechs, Temenos accelerates innovation by giving new fintech solutions the exposure they need to financial institutions of every size. The addition of this powerful end-to-end card payment platform to Temenos MarketPlace enables banks to deliver a complete digital and mobile payment user experience, whether they are a digital-first challenger looking for a swift and easy deployment and short time to market, or an established player seeking to embrace digital transformation and keep pace with customer expectations.

Read the press release on Temenos website

Learn more about CARD 3.0 IE

Contact us

Get in touch to discover how we can help in achieving your business goals