Insights

A collection of our recent articles, white papers, webinars, reports and videos.

T2/T2S Consolidation go-live date likely to shift as ECB responds to pressure from banks

TAS International acquires INFRAXIS AG

Milan, June 8th, 2020 – TAS International SA, the wholly-owned subsidiary of TAS S.p.A., has today signed a binding agreement for the acquisition of the Swiss company, Infraxis AG, and its British subsidiary, Infraxis Ltd (UK).

Infraxis is a leading company in the Swiss and German payment markets, where in the latter its PayStorm processing solution currently authorizes payments for approximately 30% of all issued credit cards. PayStorm supports both card and instant payment solutions within a microservice, omni-channel framework, where ultimate flexibility, scalability and reliability are assured for deployments within private and public cloud networks. Infraxis also provides quality assurance and testing solutions based upon its enterprise-wide, on-demand testing solution IQS, which offers simulation and testing for all aspects of payment infrastructure.

With this acquisition, TAS Group increases its market coverage in both Switzerland and Germany, where it is already present within the Capital Markets sector. TAS will now offer agile processing solutions across all verticals of the payment market, increasing its offerings within existing countries of operation, such as its home market Italy, and empowering its expansion internationally.

The integration of the two companies is expected to result in significant growth for the combined business, primarily due to an increase in turnover at an international level. Significant synergies are envisaged linked to both cross-selling opportunities and platform rationalization in the areas of card program management, credit, debit and fuel card issuance, mobile payments and fuel payment processing.

President Dario Pardi commented: "This acquisition forms part of the strategy laid out in the 2020-22 Business Plan, approved in March, where international expansion is one of the fundamental growth parameters. The acquisition of Infraxis is certainly an important step for TAS Group considering that with the new skills and solutions acquired, TAS will now play a primary role in the digital payments sector at a European level. The confident investment in the capital of TAS International by the current shareholders of Infraxis further confirms the validity of the business plan, and guarantees a combined contribution towards a successful and fruitful Business Integration".

CEO Valentino Bravi added: “We are now entering the concrete phase of the new TAS following the complete financial restructuring and the strengthening of our organisation. TAS is now a completely transformed business, capable of seizing every opportunity that our market offers. The acquisition of Infraxis represents a continuation of our rapid progress and it enriches us with new solutions in the world of Digital Payments, with unique specificities such as the one dedicated to the Fuel Card sector. Furthermore, it allows us to expand our presence in countries with high payment digitization rates, such as Switzerland and Germany. We view this acquisition as being the strategic starting point for further international momentum".

Manfred Thomi, CEO of Infraxis concluded: “The bringing together of Infraxis and TAS marks the start of the next exciting chapter for us. We at Infraxis are looking forward to offering our customers the benefits of a wider combined set of complementary payment solutions, which are backed up by a strong corporation with an international outlook. We are now perfectly positioned to better serve existing customers and to expand the TAS business internationally.”

Read the entire Press Release in the Investor sectionTAS Group & Rise Against Hunger: meals delivered to Zimbabwe schools

Beyond Target2 / T2S Consolidation

Need some expert help with ECMS or T2/T2S Consolidation? Get in touch

TAS launches PAG€: the cloud-based Access Gateway to the Eurosystem Single Market Infrastructure Service (ESMIG)

PecunPay to migrate to CARD 3.0 IE to support its rapid expansion

The new ECMS is coming – now is the time to act

TAS Group has been closely following the developments of the new Eurosystem Collateral Management System (ECMS) as it has been doing for the T2 / T2S Consolidation milestone, and is actively helping banks to prepare, especially in managing collateral and treasury funding.

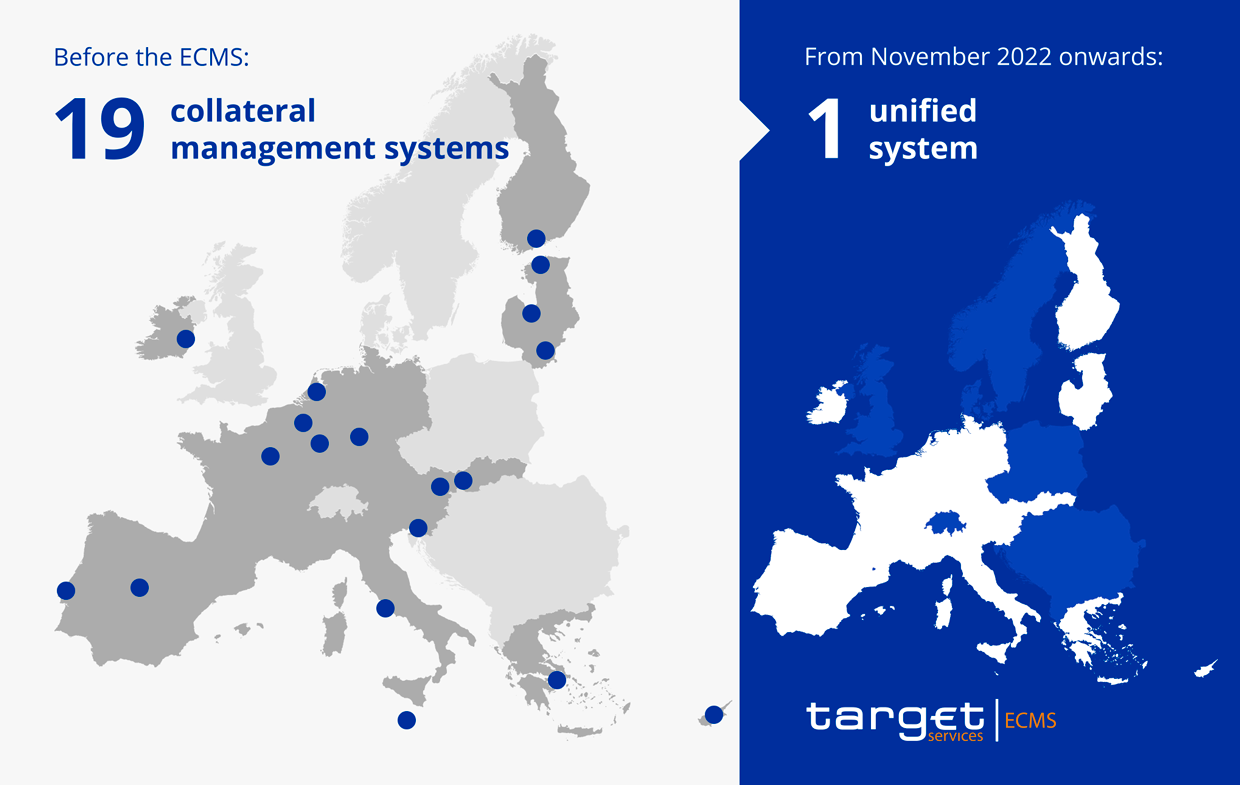

The ECMS, scheduled to go live in November 2022, will replace the existing individual systems of the 19 national central banks that are currently managing assets used as collateral for Eurosystem credit operations.

Our Aquarius Liquidity Management platform already manages the Central Bank’s Pooling Account and will guarantee in the future all the features currently being specified for the ECMS, in synergy with the liquidity management and securities settlement functions already covered by the solution.

Follow us to stay updated on the collaborative path led by TAS Group in partnership with Accenture and KPMGNeed some expert help with ECMS or T2/T2S Consolidation? Get in touch

Payment Intelligence: a new console for Customer Insight

TAS Group doubles donation for Coronavirus research

Employees donate hours of work which the company transforms into a double donation to the IRCCS Policlinico Foundation “San Matteo” in Pavia and the National Institute of Infectious Diseases “Lazzaro Spallanzani” in Rome. CARIPLO Foundation in turn doubles the allocation to San Matteo.

Milan, April 14, 2020 – During this period of great tension and concern for the health of all citizens, also TAS Group is driving a charity initiative in favor of the fight against COVID-19. The company has chosen to contribute to research into the new coronavirus, donating to two centers of excellence that are conducting some of the most advanced studies in Italy: the IRCCS Policlinico San Matteo Foundation in Pavia and the Lazzaro Spallanzani National Institute for Infectious Diseases in Rome. TAS Group employees involved in the initiative have chosen to either donate hours of their gross salary or an amount of leave to the cause. To encourage donations, the company has committed itself to doubling the amount raised, and has also involved the Cariplo Foundation in the initiative, who committed to doubling the donation for the San Matteo institute. The funds raised will go towards the purchase of scientific equipment (sequencers, freezers, thermal cyclers, processors and screens) necessary for a specific COVID-19 research project carried out by the Infectious Diseases Unit of the Pavia hospital, which has since the beginning engaged daily in the treatment of hundreds of infected people. A further contribution was sent to the Spallanzani Institute in Rome to finance a similar initiative. “We believe that in this time of global difficulty, which endangers the health of people as well as the economy, it is fair that all those who have the possibility, as individuals but above all as businesses, give their contribution for the resolution of the crisis. Among all the initiatives worthy of help, we have chosen to support the one that we feel is closest to our corporate spirit, that is, the search for solutions that allow us to face and manage critical situations that are changing rapidly. It's what we do every day for payment systems, today we want to do it for a bigger cause,” declares Valentino Bravi, CEO of TAS Group. “We proposed the initiative to our employees and it was immediately warmly welcomed with a large take up. This makes us feel even more united as a group and part of the common effort to get out of this crisis as soon as possible.” Download the press releaseContact us

Get in touch to discover how we can help in achieving your business goals